Amazon.com Inc. (NASDAQ: AMZN)

has once again demonstrated its resilience and growth potential with a strong

performance in the first quarter of 2025. Despite facing macroeconomic

challenges, including tariff concerns and fluctuating consumer demand, Amazon's

diversified business model and strategic investments continue to drive

impressive financial results. This article delves into Amazon's Q1 2025

earnings, evaluates its stock performance, and explores the company's growth

prospects and potential risks.

About Amazon

Founded in 1994 by Jeff Bezos,

Amazon, has evolved from an online bookstore into a global conglomerate

encompassing e-commerce, cloud computing, digital streaming, and artificial

intelligence. Headquartered in Seattle, Washington, Amazon operates through

various segments, including North America, International, and Amazon Web

Services (AWS). The company's commitment to customer-centric innovation and

operational efficiency has solidified its position as a leader in multiple

industries.

Amazon Financial Performance

Amazon’s financial performance in

the first quarter of 2025 highlights its solid fundamentals and continued

growth momentum, reinforcing its strong position in the global technology and

e-commerce sectors. The company reported quarterly revenue of $155.66 billion,

marking an 8.62% increase compared to $143.31 billion in Q1 2024. This steady

top-line growth reflects Amazon’s resilience in a competitive market, supported

by strong performances across its core segments, including Amazon Web Services

(AWS), e-commerce, and advertising. Earnings per share (EPS) rose significantly

to $1.59 from $0.98 in the same quarter last year, representing a 62.24%

year-over-year increase, driven by higher operating efficiencies.

On a trailing twelve months (TTM)

basis, Amazon generated $650.31 billion in revenue, up 10.08% from $590.74

billion a year earlier. Its TTM EPS surged to $6.14, a notable 72.24% increase

from the prior year’s $3.56, reflecting the company’s ability to scale

operations and enhance profitability. Amazon also maintains a strong margin

profile, with a gross profit margin of 49.16%, a net profit margin of 10.14%,

and a free cash flow (FCF) margin of 3.2%, underscoring its operational

efficiency and ability to convert revenue into profit despite ongoing

investments in logistics and infrastructure. The company’s efficiency ratios

further highlight its financial strength, with a return on assets (ROA) of

7.63% and a return on equity (ROE) of 25.24%, indicating effective use of

capital and strong shareholder returns. Its debt-to-equity ratio of 0.52

suggests prudent financial management with moderate leverage.

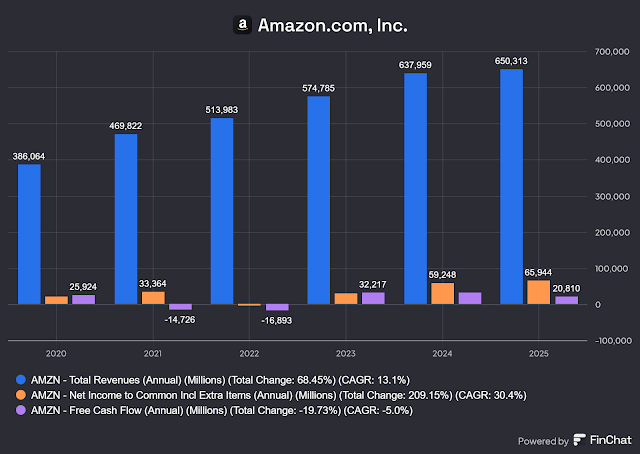

Over the past five years,

Amazon's revenue has grown at a 21.29% CAGR. Net income has been growing

steadily after the loss in 2022, while free cash flow has fluctuated.

Amazon 2025 Financial Forecast

Looking ahead, analysts forecast Amazon’s 2025 revenue to reach $694.93 billion, an 8.93% increase from 2024, while EPS is expected to rise to $6.19, an 11.97% increase from $5.53. Wall Street maintains a “Strong Buy” rating on Amazon stock, with an average 12-month price target of $240.37, representing a potential upside of 16.92% from current levels. This positive outlook further affirms investor confidence in Amazon’s long-term growth and profitability trajectory.

AMZN Stock Price Performance

and Valuation

At the time this article is

written, Amazon’s stock is trading at $205.59, marking an 11.9% increase over

the past year, which is in line with the S&P 500’s 12.3% gain during the

same period. Over a longer five-year horizon, Amazon’s stock has appreciated by

70.6%, underperform the S&P 500’s 107.5% rise. This relative

underperformance while concerning may indicate a more attractive entry point

for investors.

Amazon's valuation metrics

provide further insight into its investment appeal. The company has a trailing

twelve-month (TTM) price-to-sales (P/S) ratio of 3.33 and a forward P/S ratio

of 3.14, reflecting reasonable multiples given its scale and growth potential.

The price-to-earnings (P/E) TTM ratio stands at 33.5, with a forward P/E of

33.18, aligning with expectations for continued earnings expansion. While the

price-to-free cash flow (P/FCF) TTM ratio is notably high at 106.08.

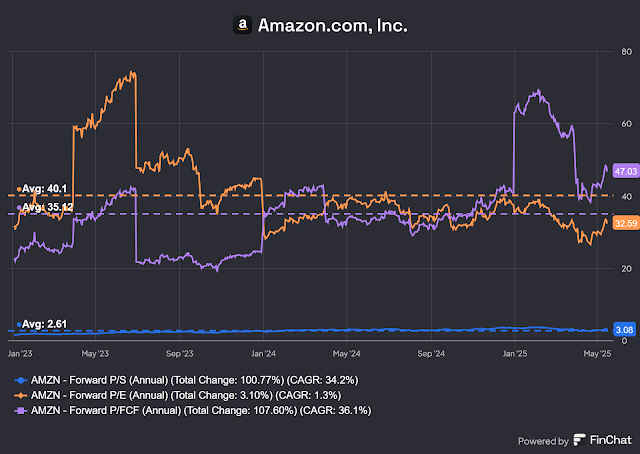

Based on FinChat data, if we look

at the valuation from 2023 until now, the forward P/S is above the average of

2.61, and the forward P/FCF is above the average of 35.12. However, the forward

P/E is below the average of 40.11, which indicates that the stock may be

undervalued. Although Amazon is not projected to grow rapidly, it still shows

solid growth, especially in earnings, and the lower forward P/E makes the

current valuation attractive.

Amazon Growth Potential

Amazon's growth prospects remain

robust, driven by several key factors:

- AWS Cloud Dominance and AI

Innovation

Amazon Web Services (AWS) reported 17% revenue growth in Q1 2025, reaching a $117 billion annualized run rate, driven by steady enterprise cloud migration and multi-year client commitments like Anthropic, which leverages Amazon’s custom Trainium and Inferentia AI chips. AWS is embedding generative AI across its cloud stack, launching services such as Bedrock (managed AI models) and Amazon Q (developer assistant), while its Agentic AI Group focuses on automating workflows like supply chain and customer service.

CEO Andy Jassy highlighted that Amazon’s custom chips reduce AI inference costs by up to 40% compared to competitors, enhancing AWS’s cost efficiency. To meet demand, Amazon plans to invest $105 billion in data centers in 2025, expanding in Southeast Asia and Europe, despite near-term capital expenditure pressures on free cash flow. - Strong Retail and Advertising

Segment

Amazon’s retail segment boosted margins through a regionalized fulfillment network, cutting delivery distances by 25% and reducing per-unit costs by 15%. With over 150 same-day delivery sites worldwide, Prime members in major cities now enjoy 12-hour delivery, contributing to a 17% year-over-year increase in North America’s operating income to $5.8 billion.

The company expanded its luxury offerings via a partnership with Saks, featuring brands like Dolce & Gabbana and Balmain, while adding new brands such as Oura Rings and The Ordinary to attract high-income shoppers. Third-party seller services grew 18% year over year, now accounting for 62% of total retail sales. Amazon’s advertising business continues to gain momentum, reached $13.9 billion in Q1 revenue, increased 19% year over year growth, with sponsored product ads and Amazon DSP increasingly popular among CPG and automotive advertisers. - Project Kuiper Satellites

Amazon officially launched the first 27 satellites of its Project Kuiper constellation on April 28, 2025, from Cape Canaveral aboard a United Launch Alliance (ULA) Atlas V rocket, marking the start of its $10 billion satellite broadband venture. The mission, named KA-01, deployed satellites at about 280 miles altitude, using the most powerful Atlas V configuration ever flown.

Project Kuiper aims to build a constellation of 1,618 satellites by July 2026 to meet FCC requirements, eventually expanding to over 3,200 satellites to provide global high-speed internet, especially in underserved regions. Amazon plans future launches using Blue Origin’s New Glenn and Arianespace’s Ariane 6 rockets for cost efficiency and is partnering with Vodafone and Jio to bundle Kuiper broadband with mobile services in India and Africa. The company expects to begin customer service later in 2025.

Risks to Consider

While Amazon's outlook is

positive, investors should be mindful of potential risks:

US Tariff Risk

Amazon faces increased business risks due to U.S. tariff policies impacting its supply chain and costs. Recent tariff hikes on Chinese imports-up to 30%for commercial carriers and the removal of the $800 de minimis exemption and added 54% tariff, have significantly raised import expenses. For example, tariffs can make significant increase to the cost of products like smartwatches. These changes force Amazon and its third-party sellers to adjust sourcing strategies, often shifting to countries like Vietnam or Mexico, which also face substantial tariffs.

This results in margin compression and higher prices for consumers, potentially reducing demand. Additionally, regulatory scrutiny and political tensions, highlighted by disputes over tariff disclosures, add complexity. Overall, U.S. tariffs increase Amazon’s operational costs, complicate compliance, and create uncertainty around profitability and growth, making tariff policy a critical factor in Amazon’s business risk landscape.Competitive Risks

Amazon's e-commerce business faces intense competition from Chinese companies like Temu and Alibaba, which offer low prices and fast shipping. Traditional retailers such as Walmart, Costco, and Target have also enhanced their digital and omnichannel strategies, putting pressure on Amazon’s market share. Specialty retailers are competing aggressively on price and customer experience. This competitive landscape could squeeze Amazon’s pricing power and margins, given that e-commerce still accounts for over 80% of its revenue.- Regulatory and Legal Risks

Amazon is subject to increasing regulatory scrutiny in the U.S. and abroad. It faces a major lawsuit from the Federal Trade Commission and multiple states accusing it of abusing market dominance, inflating prices, and stifling competition. This legal battle is expected to go to trial in October 2026. Additionally, Amazon has faced regulatory hurdles in the EU, such as the blocked acquisition of iRobot, highlighting global challenges to its business practices.

Conclusion

Amazon's Q1 2025 performance

underscores its resilience and growth potential amid challenging economic

conditions. The company's diversified revenue streams, strategic investments in

technology and infrastructure, and commitment to customer satisfaction position

it favorably for long-term success. While potential risks exist, Amazon's

strong financials and market leadership make it a compelling investment

opportunity for those seeking growth and value in the technology sector.

Comments

Post a Comment