Affirm Holdings Inc. (NASDAQ: AFRM), a leader in the Buy Now, Pay Later (BNPL) sector, has demonstrated impressive growth and financial improvement in its Q3 FY2025 earnings report. With a significant increase in revenue and a notable turnaround in earnings per share, Affirm's performance indicates a robust trajectory. This article delves into Affirm's recent financial results, stock performance, valuation, growth prospects, and associated risks, providing a comprehensive analysis for potential investors

About Affirm

Founded in 2012 by Max Levchin,

co-founder of PayPal, Affirm Holdings Inc. is a financial technology company

specializing in BNPL services. Headquartered in San Francisco, California,

Affirm offers consumers flexible payment solutions, allowing them to split

purchases into manageable installments. The company partners with over 358,000

merchants and serves more than 22 million users across the United States,

Canada, and the United Kingdom.

Affirm Financial Performance

In Q3 FY2025, ending March 2025,

Affirm reported revenue of $783.14 million, a 35.92% increase from $576.16

million in Q3 FY2024. The company achieved a positive EPS of $0.01, a

significant improvement from the -$0.43, increased 102.33% year over year.

On a trailing twelve months (TTM)

basis, revenue reached $3 billion, up 42.55% year-over-year from $2.11 billion,

while EPS improved from -$2.22 to -$0.19, a 91.44% reduction in net loss. Free

cash flow per share (TTM) increased 97.91% from $0.91 to $1.9, indicating

enhanced operational efficiency.

Affirm's gross profit margin

stands at 45.44%, with a net profit margin of -2.07% and a free cash flow

margin of 20.24%. Return on assets is -1.38%, and return on equity is -2.26%, which

are still negative because Affirm is not yet profitable, but it is beginning to

move toward profitability.

Over the past 5 years Affirm has

been able to grow its revenue at 51.9% CAGR, net income still negative but

decreased significantly in 2025 and could become profitable in 2026. While free

cash flow already positive in 2024 and continue to grow until now.

Affirm 2025 Financial Forecast

Looking ahead, analyst project

Affirm to continue the growth, with forecasted revenue of $3.18 billion for

FY2025, a 37% increase from FY2024's $2.32 billion. Non-GAAP EPS is projected

at $2.13, a substantial rise from the previous year's -$1.65. The average

analyst price target is $66.53 with Strong Buy rating, suggesting a potential

upside of 28.66% from current levels.

AFRM Stock Price Performance

and Valuation

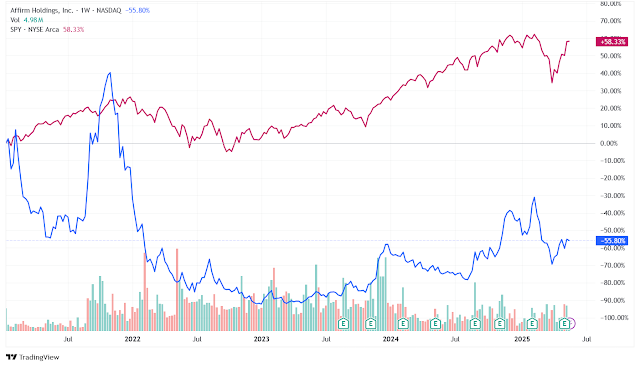

At the time this article is

written, Affirm's stock is trading at $51.71 per share, marking a 56.5%

increase over the past year, outperforming the S&P 500's 12.2% gain in the

same period. However, since its IPO in January 2021, the stock is down 55.8%,

underperforming the S&P 500's 58.3% rise. This is because the stock is

overvalued at IPO.

In terms of valuation, Affirm's

current price-to-sales (P/S) ratio is 5.59, with a forward P/S of 5.33. The

forward price-to-earnings (P/E) ratio stands at 24.64, while the price-to-free

cash flow (P/FCF) ratio is 27.4.

Based on FinChat data, if we look

at the forward P/S ratio since 2022, the current ratio is in line with the

average, which is a good sign, and Affirm’s business is still growing rapidly.

Despite past volatility, Affirm is reasonably valued given its growth prospects

and improving financials.

Affirm Growth Potential

Affirm's growth trajectory is supported by several factors:

- Repeat Customer Ecosystem and

Brand Loyalty

Affirm's customer retention metrics signal a structural advantage. With 94% of transactions from repeat users, the company has cultivated a sticky user base that generates predictable revenue streams. This loyalty is reinforced by the Affirm Card, which saw increased adoption in Q3, particularly among prime and super-prime borrowers attracted to 0% APR offers. CEO Max Levchin emphasized that these borrowers often transition to cardholders, enhancing lifetime value through cross-selling opportunities.

The company's "everyday spending" strategy, exemplified by the World Market collaboration, diversifies GMV beyond discretionary categories like electronics. Affirm's virtual card integration with Apple Pay and Google Pay further embeds its services into daily consumer transactions, driving incremental GMV growth. - Product Innovation and

Merchant Partnerships

Affirm continues to innovate beyond traditional BNPL offerings. Its debit+ product, which combines checking account features with rewards, and B2B tools for merchants are gaining traction. These products deepen engagement with existing users while attracting new demographics. For instance, 0% APR plans now account for 44% of GMV growth year-over-year, reflecting merchant demand for promotional financing.

Merchant network expansion remains a cornerstone of growth. Affirm added 23% more active merchants year-over-year, reaching 358,000 partners. Large enterprise clients increasingly request customized 0% APR campaigns, which, while less profitable per transaction, drive customer acquisition and brand visibility. The company's API-first approach enables seamless integration with e-commerce platforms, reducing implementation friction for new partners. - International Expansion and

Market Diversification

Affirm is strategically expanding internationally by leveraging its partnership with Shopify to enter new markets. This collaboration grants Affirm access to Shopify's extensive network of over 1.7 million merchants, facilitating a seamless rollout of Shop Pay Installments across various regions. The expansion commenced in Canada and is set to extend to the U.K., Australia, and Western Europe, beginning with France, Germany, and the Netherlands .

France and Germany alone represent a combined addressable Gross Merchandise Volume (GMV) of potentially $120 billion, underscoring significant growth potential. Affirm's approach focuses on empowering merchants by offering transparent, flexible payment solutions that enhance consumer purchasing power and drive higher conversion rates. This international strategy not only diversifies Affirm's market presence but also strengthens its position in the competitive Buy Now, Pay Later (BNPL) landscape.

Risks to Consider

While Affirm presents a compelling investment opportunity, investor should be aware of potential risk:

- Finance & Corporate Risks

Affirm's primary financial risks stem from its bank-dependent lending model. If regulators challenge its partnership structure (used to originate loans), the company could face legal penalties, enforcement actions, or operational disruptions if forced to secure alternative banking licenses. Funding reliance on warehouse credit, securitization trusts, and forward flow agreements creates vulnerability, failure to renew these could destabilize liquidity.

Risk-sharing pacts with third-party loan buyers expose Affirm to financial liabilities if defaults exceed projections. Counterparty risks further compound these challenges, as instability among partner banks or financial institutions might impair funding access or operational continuity. Collectively, these interdependencies threaten Affirm’s ability to scale sustainably while navigating regulatory scrutiny and maintaining profitability. - Credit and Accounting Risks

Affirm’s allowance for credit losses is based on complex assumptions and forward-looking estimates, following accounting standards like CECL, which require recognizing expected lifetime credit losses upfront. If these estimates prove inaccurate, Affirm may face losses exceeding reserves or need to increase provisions, negatively impacting financial results.

The company’s quarterly earnings have shown significant volatility, which can influence investor confidence and stock valuation. Additionally, maintaining robust internal controls over financial reporting is essential; any failure could delay or impair accurate financial disclosures, damaging Affirm’s reputation and market value. These credit and accounting risks underscore the challenges in accurately forecasting loan performance and ensuring transparent, timely financial reporting in a dynamic economic environment. - Macroeconomic and Market Risks

Affirm’s business is highly sensitive to macroeconomic factors including inflation, interest rates, and consumer spending patterns. Persistent high inflation can erode consumers’ purchasing power, while rising interest rates may increase borrowing costs, both potentially reducing demand for Affirm’s buy-now-pay-later and lending products.

Additionally, an economic recession or slowdown could lead to higher default rates and lower loan origination volumes, adversely impacting revenue and profitability. Market volatility and trade tensions have also contributed to fluctuations in Affirm’s stock price, reflecting investor concerns about the company’s ability to sustain growth and achieve profitability amid uncertain economic conditions. These macroeconomic and market risks highlight the vulnerability of Affirm’s business model to broader economic cycles and investor sentiment.

Conclusion

Affirm Holdings Inc. has

demonstrated significant growth and financial improvement in its Q3 FY2025

earnings, with strong revenue increases and a return to positive EPS. The

company's strategic initiatives, including product diversification, geographic

expansion, and technological innovation, position it for continued success in

the evolving financial services landscape. While potential risks exist,

Affirm's robust performance and growth prospects make it a compelling

investment opportunity for those seeking exposure to the fintech sector.

Comments

Post a Comment