Palomar Holdings (NASDAQ: PLMR),

a leading specialty insurance provider, has recently delivered a strong Q1 2025

earnings report that underscores both impressive growth and robust value. With

revenue surging nearly 47%, free cash flow per share more than doubling, and

analysts maintaining bullish outlooks, this quarter’s performance marked a

compelling narrative for long-term investors. In this article we will dive into

Palomar recent earnings, stock performance & valuation, growth potential,

and the risks investor should consider.

About Palomar Holdings

Palomar Holdings, Inc., founded

in 2014 and headquartered in La Jolla, California, is a specialty property and

casualty insurance company. It focuses on underwriting catastrophe-exposed

risks such as earthquake, hurricane, flood, and inland marine across

residential and commercial markets. Palomar operates in both admitted and

excess & surplus lines, distributing its products through retail agents,

brokers, and program administrators. The company leverages proprietary

technology and advanced risk analytics to drive underwriting precision and efficiency.

Palomar went public in April 2019 under the ticker PLMR on NASDAQ. Its

diversified strategy and data-driven approach position it strongly in the

specialty insurance space.

Palomar Financial Performance

In the first quarter of 2025,

Palomar Holdings delivered outstanding financial results that highlight its

accelerating growth trajectory. The company reported revenue of $174.63 million,

marking a 47.33% increase from $118.54 million in Q1 2024. Earnings per share

(EPS) also saw significant improvement, rising 62.69% year-over-year to $42.92,

compared to $26.38 in the same quarter of the previous year.

On a trailing twelve-month (TTM)

basis, revenue reached $609.96 million, up 50.51% from $405.26 million in Q1

2024, while TTM EPS climbed 43.71% to $5.02, compared to $3.49. A particularly

notable highlight is the company's free cash flow per share, which more than

doubled, surging 126.73% year-over-year to $11.79 from $5.20. Profitability

metrics remain strong, with a gross profit margin of 30.93%, net profit margin

of 21.99%, and an exceptional free cash flow margin of 51.63%. Efficiency

ratios further underscore the company’s solid fundamentals, with Return on

Assets (ROA) at 4.96% and Return on Equity (ROE) at an impressive 20.76%. With

no significant debt on its balance sheet, Palomar maintains a conservative

financial structure.

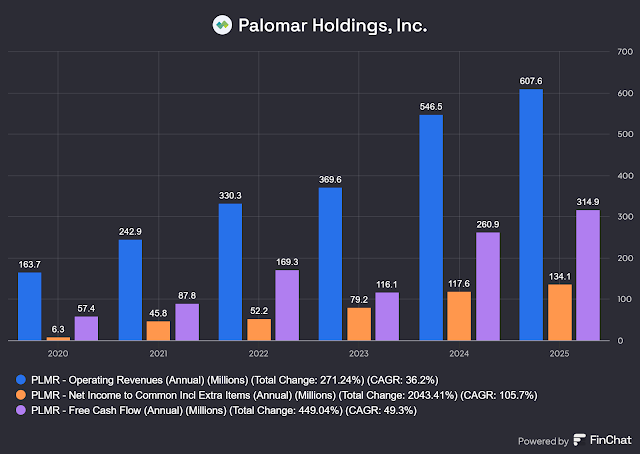

Over the past five years,

Palomar's revenue has been growing at a 36.2% CAGR, net income at 105.7%, and

free cash flow at 49.3%. Palomar is one of the fastest-growing insurance

companies, and with the Q1 2025 financial results still showing rapid growth,

this momentum could continue.

Palomar Fiscal 2025 Financial

Forecast

Looking ahead, analysts forecast 2025

revenue of $733.86 million, representing a 42.92% increase over 2024’s $553.86

million, and expect non-GAAP EPS to rise to $7.10, a 39.58% improvement from

$5.09. The stock also carries a "Buy" rating, with an average price

target of $183, a potential upside of 12.75%, and a high target of $205,

offering as much as 26.31% upside potential.

PLMR Stock Price Performance

and Valuation

At the time this article was written the stock was trading at $162.3 per share. Palomar Holdings’ stock has shown exceptional performance in the equity market, increased 100.6% over the past year, significantly outperforming the S&P 500’s 10.1% gain during the same period. Since its IPO in April 2019, the stock has appreciated by a remarkable 712.3%, again outpacing the S&P 500’s 104.9% return in that timeframe.

Despite this substantial price appreciation, the stock remains

attractively valued based on key financial ratios. Palomar currently trades at

a price-to-sales (P/S) ratio of 6.85 (TTM), with a forward P/S of 5.86,

suggesting strong future sales relative to its market value. The company’s non-GAAP

price-to-earnings (P/E) ratio is 32.07, with a forward P/E of 25.77, indicating

investors are paying a reasonable premium for Palomar’s consistent earnings

growth. Moreover, the price-to-free-cash-flow (P/FCF) ratio stands at a

compelling 13.83, reflecting undervaluation compared to its growth.

Based on FinChat data, if we look

at the valuation over the past five years, the forward P/S is slightly below

the average, while the forward P/E and P/FCF are significantly below the

average, especially the P/FCF. This indicates a potential undervaluation, as

Palomar is still projected to grow rapidly.

Palomar Growth Potential

Palomar growth prospect remains

strong, driven by several factors.

- Revenue and Premium Growth

Palomar's Q1 2025 results showcase robust top-line expansion that provides a solid foundation for future growth. Gross written premiums increased 20.1% year-over-year to $442.2million, compared to $368.1 million in Q1 2024. More impressively, the company achieved 37% same-store growth when excluding discontinued lines of business, demonstrating strong underlying momentum across its specialty product portfolio.

Net earned premiums increased 52.1% compared to the prior year's first quarter, reflecting the company's growing market presence and successful product expansion. This substantial growth in earned premiums indicates that Palomar is not only writing more business but also retaining and earning on that business effectively. - Market Position and

Competitive Advantages

Palomar has established itself as a leading specialty insurer with access to both admitted and surplus lines paper. The company's multi-channel distribution network serves residential and commercial clients, with products that resonate with producers, other insurers, and reinsurers.

The experienced management team brings industry expertise and longstanding collaboration, positioning the company to capitalize on market dislocations and growth opportunities. The company's "A" (Excellent) financial strength rating from A.M. Best provides credibility and competitive positioning in the marketplace. - Raised 2025 Guidance

Based on strong Q1 performance and successful reinsurance renewals, Palomar raised its full-year 2025 adjusted net income guidance twice during the quarter. The company initially increased guidance from $180-192 million to $186-200 million following Q1 results, and subsequently raised it again to $195-205 million after completing successful June 1st reinsurance programs.

This upward revision reflects management's confidence in the company's ability to sustain growth momentum throughout 2025. The guidance includes an estimate of $8-12 million of catastrophe losses for the remainder of the year, demonstrating conservative risk management.

Risks to Consider

While Palomar growth is strong,

we should be mindful of potential risk.

- Profitability and Risk in New

Growth Areas

Palomar’s expansion into new lines such as fronting, professional liability, and casualty insurance carries significant risks. These areas are more complex and volatile compared to its traditional earthquake insurance business. Challenges include accurately pricing risks and managing reserves, with the potential for unexpected claims and reserve charges similar to those seen by industry peers. Failure to achieve expected returns in these segments could lead to investor confidence loss and stock price decline. - Catastrophe Exposure

Palomar remains vulnerable to large-scale catastrophic events, particularly earthquakes. Although the company has a robust reinsurance program designed to mitigate these risks, significant tail risk remains. The company uses a conservative risk management approach, including catastrophe excess of loss and quota share reinsurance contracts, and maintains diversified reinsurance partners. However, large natural disasters could still impact financial results. - Competitive Pressure in

Professional Liability

The professional liability insurance market is becoming increasingly competitive, which could lead to pricing pressure and reduced profit margins. As more insurers enter this space, Palomar’s ability to maintain growth in this segment may be challenged, especially given its focus on underserved markets with limited competition.

Conclusion

In conclusion, Palomar Holdings

(PLMR) stands out as a high-performing specialty insurance company with a

compelling combination of strong financial performance, attractive valuation,

and long-term growth potential. With a well-diversified business model,

disciplined underwriting, and expanding presence in high-demand insurance

segments, Palomar is well-positioned to sustain its momentum. While investors

should be mindful of risks such as catastrophe exposure and market competition,

the company’s strong fundamentals, risk management, and strategic execution

make PLMR a stock worth considering for growth-oriented portfolios.

Comments

Post a Comment