TransMedics Group Inc. (NASDAQ:

TMDX) has emerged as a standout performer in the medical technology sector,

delivering robust financial results and demonstrating significant growth

potential. The company's Q1 2025 earnings report highlights its impressive

revenue and earnings growth, driven by the increasing adoption of its

innovative Organ Care System (OCS). This article delves into Transmedics recent

financial results, stock performance, growth prospects, and the risks investor

should consider.

1. About TransMedics

Founded in 1998 and headquartered

in Andover, Massachusetts, TransMedics Group Inc. specializes in organ

transplant therapy. The company has developed the Organ Care System (OCS), a

portable platform designed to maintain donor organs in a near-physiologic state

outside the human body. This technology addresses the limitations of

traditional cold storage methods, potentially improving transplant outcomes and

expanding the donor organ pool. TransMedics offers OCS solutions for lung,

heart, and liver transplants, positioning itself as a leader in organ

preservation and transportation.

2. Transmedics Financial

Performance

In Q1 2025, TransMedics reported

revenue of $143.54 million, a 48.2% increase compared to $96.85 million in Q1

2024. This growth was primarily driven by strong liver OCS sales, which reached

$109.1 million, surpassing expectations. The company's earnings per share (EPS)

for the quarter doubled to $0.70 from $0.35 in the same period last year.

On a trailing twelve months (TTM)

basis, revenue grew by 64.43% year-over-year, reaching $488.23 million, while

EPS improved significantly from a loss of $0.32 to a gain of $1.41. The company

also achieved a gross profit margin of 59.47% and a net profit margin of

10.03%. Return on assets (ROA) stood at 4.2%, and return on equity (ROE) was an

impressive 22.99%. However, the debt-to-equity ratio was 1.95, indicating a

higher reliance on debt financing.

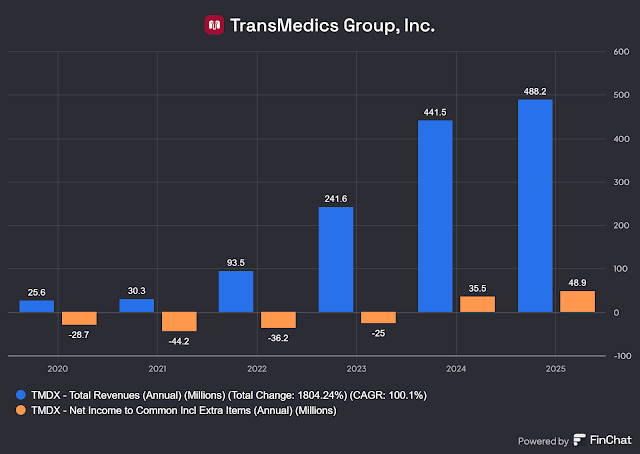

Over the past five years,

TransMedics has achieved a 100% CAGR in revenue growth, which is impressive.

Net income turned positive in 2024 and has continued to grow since then.

3. TransMedics 2025 Financial

Forecast

Analysts forecast revenue of

$580.67 million for 2025, representing a 31.51% increase from 2024's $441.54

million. EPS is projected to rise by 78.93% to $1.81 in 2025. The consensus

price target is $110.50, with a "Buy" rating, suggesting a potential

downside of 0.9% from the current price. In my opinion, due to its strong

financial performance, TransMedics has the potential to outperform the market,

suggesting an upside of more than 20% from the current price.

4. TMDX Stock Price

Performance and Valuation

At the time this article is

written, TransMedics' stock price stands at $112.72 per share. Over the past

year, the stock has declined by 13.4%, underperforming the S&P 500, which

gained 8.4% during the same period. However, over the past five years, TMDX

shares have surged by 672.1%, significantly outperforming the S&P 500's

97.1% increase.

The company's current

price-to-sales (P/S) ratio is 7.64, with a forward P/S of 6.5. The trailing P/E

ratio stands at 79.28, and the forward P/E is 61.27.

If we look at the valuation over the past five years, TransMedics' forward P/S ratio is significantly below its five-year average of 11.1, indicating that the stock is trading at a discount.

This lower valuation is due to reduced expectations for the company’s future growth. However, TransMedics has still managed to grow rapidly in Q1 2025, exceeding analyst estimates. Therefore, the current lower valuation may present a buying opportunity.

5. TransMedics Growth

Potential

TransMedics is well-positioned to

capitalize on the growing demand for organ transplants and the need for

improved preservation methods.

- Expansion of Transplant

Logistics Network

TransMedics expanded its transplant logistics network, increasing its aviation fleet to 21 aircraft by March 31, 2025, from 19 at year-end 2024, with plans to operate 20–22 aircraft by Q1 2025 to meet growing demand. The company’s transplant logistics service revenue grew 5% sequentially from $19.1 million in Q2 2024 to $20.1 million in Q3 2024, reflecting rising demand for its National OCS Program (NOP).

By optimizing fleet utilization by operating 10 planes on average in Q3 2024 despite owning 18 which means that TransMedics efficiently handles increased transplant volumes with controlled costs. The CEO emphasized that these investments position the company to capitalize on anticipated growth in OCS NOP missions in 2025 and beyond. The company’s target of 10,000 annual U.S. OCS cases by 2028 reflects a clear long-term growth runway, driven by increasing adoption and transplant volumes. - Outlook for 2025 Revised to

Positive

In a significant vote of confidence in future performance, TransMedics management has revised its full-year 2025 revenue guidance upward. The company now expects annual revenue in the range of $565 million to $585 million, representing approximately 30% growth at the midpoint compared to the previous year. This upward revision is notable as it substantially exceeds the earlier guidance of $530 million to $552 million that was announced on February 27, 2025.

The increased guidance reflects management's optimism about continued strong performance throughout 2025. This upward revision is particularly meaningful as it comes after the first quarter results, suggesting that early 2025 performance has exceeded internal projections and created confidence for the remainder of the year. The 30% projected annual growth rate indicates that while the percentage growth may moderate somewhat from the 48% seen in Q1, the company still anticipates robust expansion throughout 2025. - New Clinical Programs for

Heart and Lung Transplants

TransMedics is set to launch new clinical programs for heart and lung transplants in 2025, pending FDA approval. These programs will expand the company's addressable market beyond liver transplants, where it already holds a strong position. The OCS platform for heart and lung is expected to improve transplant outcomes by preserving organ quality and assessing viability prior to transplantation, potentially increasing the utilization of marginal organs.

Management highlighted confidence in service revenue from these programs, even as product revenue ramps up, with details dependent on FDA-approved trial designs. The launch of these programs could significantly boost revenue, given the large and growing markets for heart and lung transplants, addressing unmet needs in end-stage organ failure treatment.

6. Risks to Consider

Despite the promising outlook, Investors

should be aware of certain risks associated with TransMedics.

- Legal and Regulatory Risks

TransMedics faces significant legal scrutiny highlighted by a critical short-seller report released in January 2025. The report alleges serious misconduct including kickbacks, billing fraud, unreported device failures, off-label use, and monopolistic practices, describing the company’s operations in highly negative terms.

Such allegations could lead to regulatory investigations, legal liabilities, and reputational damage, which pose material risks to the company’s financial health and stock performance. - Market Penetration and

Logistics Complexity

TransMedics has addressed logistical challenges by developing the National OCS Program (NOP), a comprehensive network that includes trained medical specialists and a dedicated logistics fleet to support organ transport and management. This infrastructure aims to overcome previous barriers such as expensive and unreliable aircraft availability and the need for on-call medical teams, which limited scalability.

Despite these advances, the complexity of coordinating organ procurement, transport, and transplantation remains a challenge. Efficient logistics are crucial to ensuring organs remain viable and that transplant surgeries can be scheduled during regular daytime hours, which improves surgeon workflow and patient outcomes. Any disruptions or inefficiencies in this network could slow adoption and limit market penetration. - Clinical and Development

Risks

The outcomes and timing of post-approval studies and clinical trials for TransMedics’ OCS products, including new lung and heart programs launching in 2025, remain uncertain. Unfavorable results or delays could hinder regulatory approvals and limit product adoption, affecting long-term growth.

TransMedics aims to achieve 10,000 OCS transplant cases annually in the U.S. by 2028, but this goal relies on scaling clinical support and infrastructure. Execution challenges in expanding these capabilities may impede progress toward this target.

Conclusion

TransMedics Group Inc. has

demonstrated strong financial performance and significant growth potential,

driven by its innovative OCS technology and expanding market presence. While

the stock has experienced recent volatility, its long-term prospects remain

compelling. Investors seeking exposure to a high-growth medical technology

company with a unique value proposition may find TMDX an attractive addition to

their portfolios.

Comments

Post a Comment