Sea Limited (NYSE: SE), the

Singapore-based tech conglomerate behind Shopee, Garena, and SeaMoney, has

emerged as one of the most compelling growth stories in Southeast Asia. With significant improvements in profitability, strong revenue

growth, and a solid balance sheet in Q1 2025, Sea Limited presents a promising investment

opportunity for those seeking exposure to the dynamic Southeast Asian digital

economy.

1. About Sea Limited

Sea Limited, originally founded

in 2009 by Forrest Li as Garena, a digital entertainment platform rebranded in

2017 to Sea Limited to better represent its diversified business model. The

company operates three core divisions: Shopee, Garena, and SeaMoney. Shopee,

launched in 2015, has grown into the leading e-commerce platform across

Southeast Asia and Taiwan, and is also expanding its presence in Latin America.

Garena serves as Sea’s digital

entertainment arm, best known for publishing the globally popular mobile game Free

Fire. SeaMoney, the company’s digital financial services division, offers

mobile wallet solutions, payment processing, and digital banking services

across various Southeast Asian markets. As of 2022, Sea Limited employed over

67,000 people and continues to grow its influence in the region’s fast-evolving

digital economy.

2. Sea Limited Financial

Performance

Sea Limited's Q1 2025 earnings

report highlights the company's strong financial momentum, showcasing

impressive year-over-year growth across key metrics. Revenue for the quarter

reached $4.84 billion, marking a 29.64% increase from $3.73 billion in Q1 2024.

Earnings per share (EPS) rose significantly to $0.65, a notable turnaround from

a loss of $0.04 in the same quarter last year.

On a trailing twelve-month (TTM)

basis, revenue climbed to $17.92 billion, up 30.31% from $13.75 billion a year

ago, while TTM EPS surged to $1.42 from just $0.06, reflecting substantial

earnings growth. Free cash flow per share (TTM) also saw a robust increase,

rising 83.51% to $5.23 from $2.85. The company’s profitability metrics remain

strong, with a gross profit margin of 44% and a net profit margin of 4.86%.

Additionally, Sea posted a return on assets (ROA) of 3.05% and a return on

equity (ROE) of 11.13%, with a conservative debt-to-equity ratio of 0.46.

Over the past five years, Sea

Limited's revenue has grown steadily at a 39.4% CAGR, while net income and free

cash flow turned positive in 2023 and have continued to grow since then.

3. Sea Limited 2025 Financial

Forecast

Looking ahead, analysts forecast

continued growth, with projected 2025 revenue of $20.97 billion, representing a

24.66% increase over 2024 of $16.82 billion, and a Non-GAAP EPS of $3.96, a

176.97% jump from $1.43 the previous year. Analysts remain bullish on Sea

Limited, assigning a consensus “Strong Buy” rating and setting a price target

of $169.75, implying a potential upside of 5.1% from its current level. However,

I believe the stock price could go higher due to Sea Limited's strong growth

and reasonable valuation.

4. SE Stock Price Performance and

Valuation

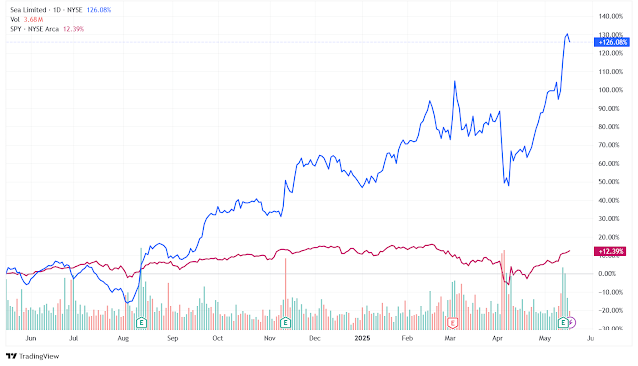

At the time this article is

written, Sea Limited’s stock is trading at $161.51. Sea Limited's stock has

delivered outstanding performance over the past year, making a remarkable 126%

gain, significantly outperforming the S&P 500’s 12.3% increase during the

same period. Over the past five years, the stock has appreciated by 104.4%,

edging out the S&P 500’s 101.1% rise.

Despite this strong rally over

the past year, valuation metrics suggest the stock remains attractively priced

relative to its growth potential. The price-to-sales (TTM) ratio stands at

5.32, with a forward price-to-sales ratio of 4.65, indicating expectations of

continued revenue growth. Sea’s Non-GAAP price-to-earnings (TTM) ratio is

65.95, and its forward P/E is 41.56, reflecting investor confidence in the

company’s future profitability. The price-to-free cash flow (TTM) is 29.46,

further supporting a balanced valuation for a growth-oriented business.

If we look at the valuation over the past five years, Sea Limited is now trading below its average forward P/S ratio of 6.22, which is a positive sign.

5. Sea Limited Growth Potential

Sea Limited is well-positioned to

capitalize on several growth drivers.

- E-Commerce Potential

Shopee's strong performance is set against a highly favorable market backdrop in Southeast Asia, where e-commerce continues to experience rapid expansion. According to Statista, the region's e-commerce market is projected to reach approximately $133.62 billion in 2025, reflecting the growing adoption of online shopping driven by increased internet penetration and a rising middle class. Statista expect the market to sustain a healthy compound annual growth rate (CAGR) of 8.79% from 2025 through 2029, which would expand the total market size to around $187.16 billion by 2029. Shopee’s established leadership position across multiple Southeast Asian countries, combined with its robust platform and localized strategies, positions it well to capitalize on this substantial regional growth opportunity and further consolidate its market share. - Rapid Growth of Digital

Payment

Monee's revenue growth was primarily driven by its consumer and SME (small and medium enterprise) credit business. The fintech segment operates in a region with significant untapped potential, as approximately 85% of adults in Southeast Asia (around 300 million individuals) remain underbanked. Additionally, MSMEs, which comprise over 97% of all businesses in Southeast Asia, face a significant credit gap of $300 billion, with over half struggling to access formal credit.

Digital payment transaction value in Southeast Asia is projected to grow at a 19.8% CAGR between 2024 and 2029, reaching nearly $1.7 trillion. This favorable market environment, combined with Monee's strong execution and risk management focus, positions the segment for continued growth. - Integrated Ecosystem and

Synergies

One of Sea Limited's key strengths lies in the potential synergies across its three business segments. The renaming of SeaMoney to Monee was deliberately chosen to "resonate well with the name of its sister brand, Shopee, reflecting the seamless, synergetic connection between the two ecosystems". This integrated approach allows Sea to leverage cross-platform user acquisition and retention strategies while creating a more comprehensive digital ecosystem.

The combination of e-commerce, digital financial services, and digital entertainment positions Sea Limited advantageously in Southeast Asia's rapidly digitizing economies. The company can leverage data and insights across segments to improve user targeting, personalization, and service offerings, potentially creating a virtuous cycle of growth across all three businesses.

6. Risks to Consider

While Sea Limited's prospects are

promising, investors should be aware of potential risks.

- Competitive Landscape

Challenges

Sea Limited operates in highly competitive sectors across all three of its core businesses. In e-commerce, Shopee delivered record-high GMV and gross order volume in Q1 2025, with revenue increasing by 28.7% to US$3.1 billion; however, it faces intense competition from both regional and global e-commerce platforms. In digital financial services, Monee operates in an increasingly crowded fintech space where traditional financial institutions and technology companies vie for market share.

Meanwhile, the digital entertainment segment, Garena, showed the slowest growth among Sea’s businesses, with revenue rising just 8.2% to US$495.6 million, which may indicate market saturation or intensifying competition. To address these challenges, the company prioritizes enhancing price competitiveness, improving service quality, and strengthening its content ecosystem, efforts that could require significant ongoing investment and potentially pressure margins if competitive pressures continue to escalate. - Geographical Concentration

Risk

While Sea Limited has been diversifying its operations, it remains heavily exposed to Southeast Asian markets and is growing its presence in Latin America, particularly Brazil. This geographical concentration creates vulnerability to regional economic cycles and market-specific challenges.

The company has indicated that growth across different markets helps diversify their overall loan book and reduces exposure to any single market's economic cycle. By the end of March 2025, Thailand's loan book surpassed $1 billion, while Brazil delivered robust loan book growth in the first quarter. However, political instability, regulatory changes, or economic downturns in key markets could still significantly impact performance. - Regulatory and Compliance

Risks

As Sea Limited expands across multiple jurisdictions and deepens its involvement in financial services, it faces an increasingly complex regulatory landscape. Digital financial services, in particular, are subject to evolving regulations around lending practices, data protection, and consumer protection.

The company's increasing loan portfolio and expansion into new markets may attract greater regulatory scrutiny. Changes in regulations governing e-commerce, digital payments, or online gaming in key markets could impact business operations and profitability.

Conclusion

Sea Limited's Q1 2025 performance underscores its resilience and growth potential in the dynamic Southeast Asian digital economy. With robust financial metrics, strategic investments, and a diversified business portfolio, the company is well-equipped to navigate challenges and capitalize on emerging opportunities. Given its strong fundamentals and growth prospects, Sea Limited remains a compelling investment for those seeking exposure to the region's burgeoning digital landscape.

Comments

Post a Comment